|

People, Profits, & Pensions |

|

Will Profits from Big Macs Add to Your Retirement Income?If you belong to a pension plan or buy mutual funds on your own, it's quite possible you're an owner of the McDonald's Corporation. That's because your pension plan, mutual fund, or whole life insurance policy buys stock in big corporations for you. What does that mean to you and what does it mean for public policy? You can find answers to these and other questions in a short new book, Big Macs & Our Pensions: Who Gets McDonald's Profits? Table of Contents:

In this short and easily-read book, you learn:

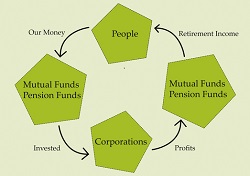

See for yourself how millions of people around the world, each contributing just a modest amount, have become the majority owners of big business. Big Macs & Our Pensions: Who Gets McDonald's Profits? is now available at Amazon.com Introduction: The Ownership RevolutionEver sit over a Big Mac in McDonald's, watching order after order fly over the counter, and wonder who makes all the profits? You might presume the profits end up in the wallets of millionaires; after all, that’s the way it always goes, right? But.... The McDonald's Corporation mostly belongs to working people, middle-class citizens. That's you and me and hundreds of millions of others around the world. Few of us became owners because we wanted a piece of the company or its profits. Instead, becoming owners was a side-effect of saving for retirement. But what a side effect! It turned out to be what I call the Ownership Revolution. Over the past 60 years or so (depending on which country you live in), ownership of big corporations has shifted from rich people to working people. At the beginning of the Ownership Revolution, the rich owned almost all of the stock in big companies. Today, that's reversed, with the majority of stocks in most big corporations belonging to working, or middle class people, through pension funds and mutual funds. Put another way, we see working people who need to fund and grow their retirement income, and we see companies that need to sell stock to expand. When these two sides began satisfying the needs of the other, a new era of corporate growth and better retirement incomes emerged. But what about the rich you ask, the 1% as some would call them? Well, we may have less money per person than the rich, but we really outnumber them. When hundreds of millions of us contribute modest amounts each payday, the sums quickly multiply into the billions and trillions. As Davis, Lukomnik, and Pitt-Watson put it in their book, The New Capitalists: How Citizen Investors are Reshaping the Corporate Agenda, "Who are these new capitalists we're talking about? Corporate power used to be wielded by wealthy tycoons or by the state.... in North America, Europe, Japan, and increasingly throughout the world, the owners of multinational corporations are the tens of millions of working people who have their pensions and other life savings invested through funds in shares of the world's largest companies. Their nest eggs constitute majority ownership of our corporate world. Each pensioner owns a tiny sliver of vast numbers of companies." (Harvard Business School Press, page xi) According to nasdaq.com (December 18, 2013), institutional investors (primarily pension funds and mutual funds) and mutual funds owned 65% of McDonald's shares. So, we will presume working people own at least two-thirds, and perhaps more, of McDonald's shares. I say presume because some millionaires may have stakes in pension or mutual funds, and at the same time, some middle class people buy McDonald's stock on their own. Ownership of stock in big corporations has two dimensions: first, sharing in the profits, and second, controlling operations. We'll focus on the profits in Big Macs & Our Pensions, but it's worth noting we also share control, indirectly, through the pension fund trustees we elect, and as individuals by buying and selling specific mutual funds. The dean of business thinkers, Peter F. Drucker, has written, "The rise of pension funds as dominant owners and and lenders represents one of the most startling power shifts in economic history." ( The Pension Fund Revolution, Transaction Publishers, 1996, page 208) In this booklet, we explore the Ownership Revolution through McDonald's shares. I chose McDonald's as an example because of its iconic status. Everyone knows the company, almost everyone has eaten its food, and millions have even worked for it. Exploring this revolution through McDonald's also allows us to look at a controversial issue connected with ownership: fast food wages. Oh yes, we’ll also estimate how much of your lunch tab ends up as a profit for McDonald’s. How just another burger joint reinvented itself to create the fast food industry comprises the first part of Chapter 1. Later in the chapter, we explore how McDonald’s went from local attraction to worldwide icon, how it makes money selling food and renting real estate, and how it returns money to shareholders through dividends, share buybacks, and reinvestments. In Chapter 2 we ask why pension funds would buy stocks, and specifically McDonald's stock. After that, a look at the many hats we wear, and at three groups of working people who became owners and now receive McDonald’s profits: the California Public Employees Retirement System, the British Columbia Investment Management Corporation (for an international perspective), and a mutual fund, the Vanguard Total Stock Market Index. In Chapter 3, we examine the contentious issue of fast food wages, through the accusations of a protest campaign and a research report. As owners, we wouldn't want to think our retirement income comes from exploitation. So, we'll listen to the messages of protesters, and analyze. We'll also explore how we, wearing our different hats, will determine the future of fast food wages. I've written this booklet for those of us who enjoy reading magazines and the editorial pages of newspapers, for those who take an interest in public affairs programs on radio and television, and for those who follow online blogs. It makes no attempt to serve experts or specialists in any area. In taking this approach, I hope we can all contribute more to political conversations, enjoy a better understanding of the economic world, and help create better public policy. The author is neither pro- nor anti-McDonald's, and has no connection with the company, other than buying a few Big Mac combos a year. I am an active stock and options trader, but do not own any McDonald's stocks or options, and will not for at least one year after publication of this booklet. I do not have any direct connection with the pension funds or mutual funds named here, though you will see one indirect connection disclosed later. The funds selected came up somewhat randomly; thousands of others might have illustrated the same points. Now, let's find out how the Ownership Revolution and the Fast Food Revolution came together to profoundly change our world. Click here to buy and read the rest of Big Macs & Our Pensions: Who Gets McDonald's Profits? |

The Ownership Cycle

Copyright 2014. Robert F. Abbott, All Rights

Reserved.

|